The world of options trading can be complex and intimidating, but with the right knowledge and tools, it can also be an exciting avenue for investment. One popular strategy among seasoned traders is the long strangle, particularly when utilized on platforms like Webull. This strategy allows investors to capitalize on significant price movements in either direction without needing to predict the direction of the movement itself. As we delve deeper into the long strangle on Webull, we will explore its mechanics, benefits, and practical tips for implementation.

Understanding the long strangle strategy is essential for traders looking to hedge against market volatility. This options trading approach involves purchasing both a call option and a put option at different strike prices but with the same expiration date. The goal is to profit from the underlying asset's price movement, regardless of whether it goes up or down. With Webull's user-friendly platform, executing a long strangle becomes accessible to both novice and experienced traders alike.

In this article, we will break down the long strangle on Webull, answering key questions about its mechanics, the best practices for execution, and how it can fit into your overall trading strategy. Whether you’re looking to enhance your trading toolkit or simply curious about this strategy, we aim to provide comprehensive insights that will empower you to make informed decisions in your investment journey.

What is a Long Strangle?

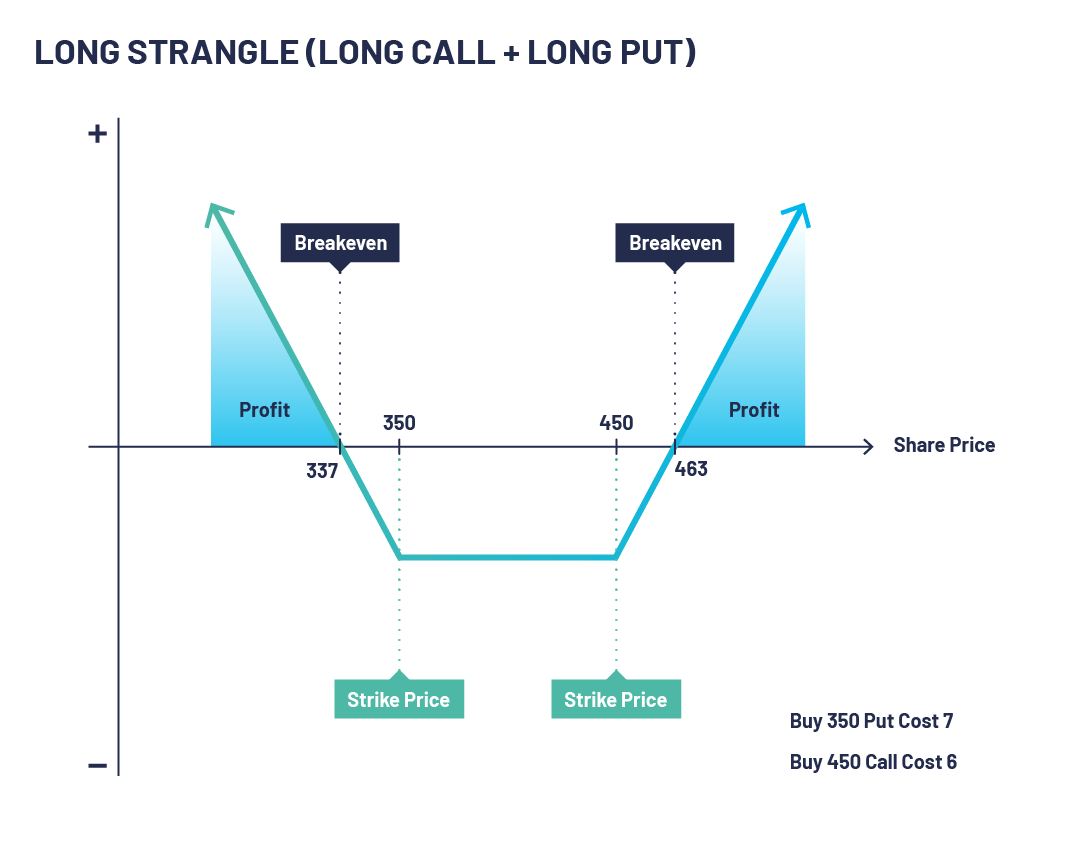

A long strangle is an options strategy where an investor buys a call option and a put option for the same underlying asset with the same expiration date but different strike prices. The call option is purchased at a higher strike price, while the put option is bought at a lower strike price. This strategy is beneficial when an investor anticipates a significant price movement but is uncertain about the direction.

How Does the Long Strangle Work on Webull?

Executing a long strangle on Webull involves a few straightforward steps:

- Select the Underlying Asset: Choose the stock or asset you want to trade options on.

- Access the Options Chain: Navigate to the options chain for your selected asset on Webull.

- Choose Your Strike Prices: Identify the strike prices for both the call and put options.

- Set the Expiration Date: Ensure both options have the same expiration date.

- Execute the Trade: Purchase both options to establish your long strangle position.

What Are the Benefits of a Long Strangle on Webull?

The long strangle strategy offers several key advantages:

- Profit from Volatility: This strategy allows traders to profit from large price movements in either direction.

- Limited Risk: The maximum loss is limited to the total premium paid for the options, providing a defined risk profile.

- Flexibility: Traders can adjust their positions based on market conditions and trends.

- Use of Webull Tools: Webull provides useful tools and resources that can help traders analyze and execute their long strangle strategies efficiently.

What are the Risks of Implementing a Long Strangle on Webull?

While the long strangle can be an advantageous strategy, it is important to be aware of the associated risks:

- Time Decay: Options lose value as they approach expiration; if the underlying asset does not move significantly, both options may expire worthless.

- High Costs: Buying two options can be expensive, especially if the premiums are high.

- Market Movement: If the underlying asset does not experience significant volatility, the trader may incur a loss.

How Do You Choose the Right Stocks for a Long Strangle on Webull?

Selecting the right stocks for a long strangle strategy is crucial for maximizing potential returns. Here are some tips:

- Look for Volatile Stocks: Focus on stocks that have a history of significant price fluctuations.

- Use Earnings Reports: Earnings announcements can lead to increased volatility; consider timing your long strangle around these events.

- Analyze Market Trends: Keep an eye on broader market trends that could impact stock price movements.

- Review Technical Indicators: Utilize Webull’s technical analysis tools to identify potential entry points.

What Tools Does Webull Offer for Long Strangle Trading?

Webull provides a variety of tools and features to assist traders in executing long strangle strategies effectively:

- Advanced Charting: Access to detailed charts and indicators to analyze stock performance.

- Options Screener: A built-in screener that helps identify potential options trades based on specific criteria.

- Market News: Stay updated with the latest market news and trends that could affect your trades.

- Risk Analysis Tools: Tools to assess the risk associated with your options trades.

Conclusion: Is a Long Strangle on Webull Right for You?

In conclusion, the long strangle on Webull can be a powerful strategy for traders looking to take advantage of market volatility. By understanding its mechanics, benefits, and risks, you can make informed decisions about whether this approach fits your trading style. As with any investment strategy, it is important to conduct thorough research and consider your risk tolerance before diving in. With Webull's robust platform and resources, you have the tools needed to successfully implement a long strangle and potentially enhance your trading success.

Article Recommendations

- Watch Hunter Hunter Phantom Rouge

- Celebrities Black Eye

- Keith Washington Singer

- Rory Feek New Girlfriend

- Ben Harper

- License Expired Over A Year

- David Lee Rothaughter

- City Base Cinemas San Antonio

- Fig Plant Indoor

- Prince Naseemiddy

Also Read